Get our report on investing trends!

By providing your email, you will shortly receive the latest report from Pepper.

Once upon a time, the secondaries playbook used to be simple: buy exposure to private companies by purchasing a portfolio of LP fund positions at a discount. As this market has grown over the last decade, there has been an aspiration for a more liquid secondaries market. This market would ideally have readily-available bid and ask prices for funds, and secondaries managers can trade in and out of partnerships with ease. The growth and liquidity for LP interests are bound by a key regulatory constraint: Publicly-Traded Partnerships.

Some of the rulings can be viewed under IRS Code Title 26 Section 7704, where a publicly traded partnership can be treated as a “corporation.”

Thus, LP interests could never be listed on an exchange, or any established securities market, or be readily available in the secondaries marketplace; else they would be considered as a corporation. Buyers and sellers have to be hyper-aware of these rules to not fall into complex tax laws triggered under these provisions.

There are a list of safe harbor laws that both buyers and sellers need to track around each interest, which include number of partners, number of trades during the year, and size of the stake in the year.

In a complex deal, a buyer acquiring multiple LP interests can have a subset of interests that could be PTP-affected. This ability to track, manage, and settle PTP assets can provide buyers key advantages in the secondaries market.

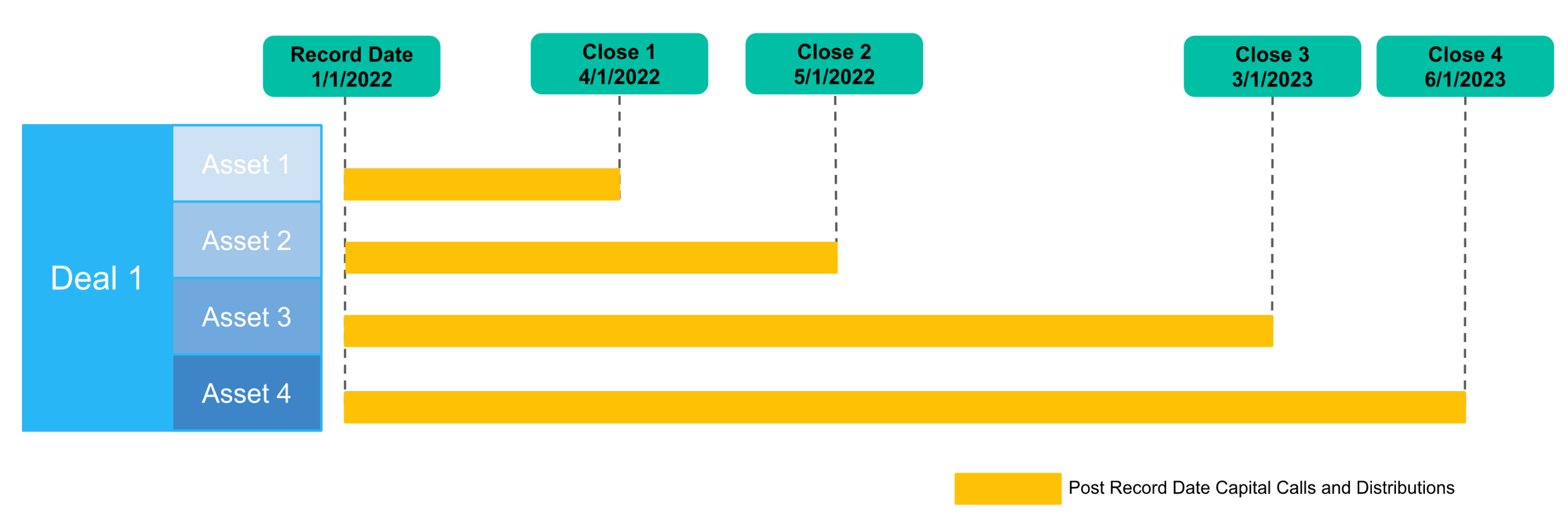

The following is an example of a simple secondaries deal in which the buyer is attempting to buy 4 assets. In this deal he may end up with 4 different closing dates. All of the assets were recorded in the buyers portfolio on January 1, 2022. The first two assets close as part of a typical secondaries closing within 90 to 120 days, but Assets 3 and 4 could be closing over one year later as separate closes.

The challenges for the buyers include:

This is just one instance of when regulations can create serious complexity in closing of a deal, and lead to complications in managing cash flows and reporting on the deal. In some cases, an entire deal could be in jeopardy if the laws have not been fully understood. Having a strong infrastructure technology platform can help asset managers navigate the complexity of PTP just like other regulatory requirements.

Sign up for our newsletter to receive biweekly updates on the world of asset management, delivered straight to your inbox.

By providing your email, you will shortly receive the latest report from Pepper.

Enter your information below to schedule a demo with us