Get our report on investing trends!

By providing your email, you will shortly receive the latest report from Pepper.

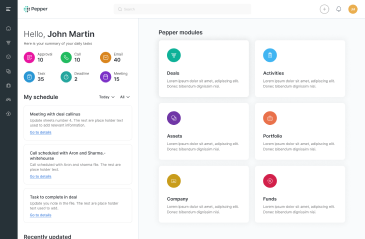

Pepper has taken a modular, unified, cloud-based and data-centric approach to developing its next-generation private markets investment platform

*Celent is a division of the Oliver Wyman Group

A cloud native world class investment data platform for asset managers providing higher efficiency, faster data access and accurate insights.

Fully customized dashboards

Predictive analytics

Deal pipeline management

Deal structuring & execution

Portfolio monitoring & reporting

Portfolio valuation

Cash flow

Compliance & risk reporting

Relationship management

Document management

Fundraising & IR

Advanced tasks like doing a scenario analysis on a portfolio, or adjusting portfolio to changing market conditions are not even contemplated today. Tasks which would greatly enhance strategic insights and operational capabilities of managing the portfolio.

John Chambers Senior Portfolio Manager

Routine tasks like calculating a borrowing base, or calculating daily liquidity require intense effort due to the very manual nature of DGRF.

Ian Botham Senior Portfolio Manager

As critical data is built on Excel based spreadsheets we run into problems of data governance, data integrity, data controls. These form a significant operational risk to organization's growth.

Erica Hans Head of Investments

Help design and architect custom cloud solutions

Create roadmap for migrating existing applications to the cloud

Optimize the cloud infrastructure and services required for hosting

Create migration plan on-prem applications to the cloud

Add new services to on prem application using the cloud

Credit portfolio management solutions

Workflow management softwares / ERP

Excel sheets reporting tools

Data visualization + analytics

Investment management tools

Register today to discover how technology is transforming the way private credit lending operates. Don't miss out on this opportunity to gain valuable insights from industry experts.

Sign up for our newsletter to receive biweekly updates on the world of asset management, delivered straight to your inbox.

Pepper is a cloud native Investment Data Platform that powers investment managers decision-making infrastructure. It has a full suite of functionality that enables Investment Managers to create a single golden source of data for all their functional requirements, investor reporting, compliance reporting, and analytics.

Pepper is built natively on the cloud and all its functionality sits on a secure cloud platform. Users access through a secured browser connection. There are no local installations. Cost of usage is based on the period of contract and the total usage of the platform. You never ever have to buy or replace an equipment. It scales effortlessly based on your needs. And you always are working on the latest version of the software.

Pepper has been designed from the ground up to be the golden sources of all your data. It integrates data across different functions like CRM, Deal Management, Documents, Portfolio Management, Accounting, and Expense Management within the organization, giving you one place to run complex reports or manage your analytics. Other systems work in silos and perform highly specific tasks, meaning you might be entering the same data in many systems and the task of keeping data updated lies with you. This becomes an impossible ask. With Pepper, you only enter data once, and we take on the responsibility of keeping your data updated.

A user can unload an unlimited number of documents related to the fund, deals, and transactions. Pepper’s document searches through every document, providing critical access to trapped information.

Pepper comes with many benefits to an Investment Manager:

1. Pepper maintains and becomes the golden source of data making it easier to develop and run complex analytics and reports

2. Never worry about buying, managing, and maintaining another server hardware, operating system, database, or security software

3. Pepper includes all data including your documents, your notes, your emails, and your calendar, reducing complexity and increasing collaboration across teams

4. Pepper reduces operational costs by over 60% while giving you better transparency and control over your data

You can request a free account here, or call us to sign up for an enterprise license.

Pepper is ready to power your enterprise and take you on the cloud transformation journey.

Pepper is highly configurable and able to meet the needs of most users. This means we are never developing software for individual users, but it still works in a highly customized fashion, meeting your specific needs. Users have control of how they want to configure the software based on their individual business needs.

Pepper is designed to work in an ecosystem. We integrate with a variety of other products that extend the productivity at an Investment Management firm. We will be happy to integrate with any tools that you are currently using and ensure seamless data flow.

Pepper is built to be used by everyone at a fund. There are no restrictions on the number of users. Every user gets his or her login based on the roles and responsibilities.

Pepper works for the Fund Manager. It captures the deals, transactions, and operations data through a variety of ways, including data imports, APIs, Excel interface, data extraction from PDFs, as well as plain old manual inputs.

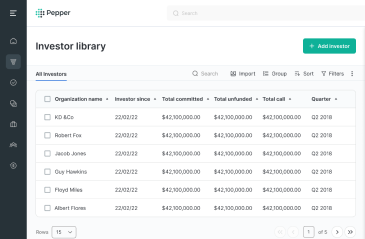

Pepper has a CRM system custom-built for asset managers. Our CRM allows portfolio managers to track every aspect of their deal flow, from key dates, contacts, documents, workflows, and files, all stored directly at the deal level. We offer at-a-glance views of all underlying holdings in each deal, coming directly from the live asset library, email and calendar integration directly into the Pepper system, as well as API connectivity to tools you may already be using, such as Slack, Dropbox, Hubspot, and more.

Pepper is an enterprise level, componentized investor data management platform for Private Credit Manager.

By providing your email, you will shortly receive the latest report from Pepper.

Enter your information below to schedule a demo with us